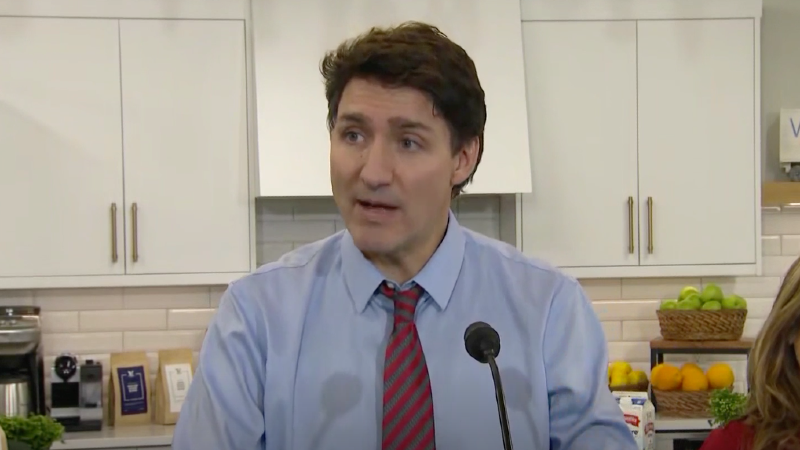

The federal government has announced a two-month GST/HST holiday on many essential items, and is promising a $250 rebate to Canadians next spring.

Starting Dec. 14, the federal government will introduce a GST/HST exemption across the country for items like groceries, snacks, and kids clothing. The new tax break will apply to:

- Prepared foods, including vegetable trays, pre-made meals and salads, and

sandwiches. - Restaurant meals, whether dine-in, takeout, or delivery.

- Snacks, including chips, candy, and granola bars.

- Beer, wine, cider, and pre-mixed alcoholic beverages below 7 per cent ABV.

- Children’s clothing and footwear, car seats, and diapers.

- Children’s toys, such as board games, dolls, and video game consoles.

- Books, print newspapers, and puzzles for all ages.

- Christmas trees.

The tax break is projected to last until Feb. 15, 2025, and will make essentially all food GST/HST free.

There will also be a “Working Canadians Rebate”. Canadians who worked in 2023 and earned up to $150,000 will see a $250 cheque in their bank account or mailbox, starting early spring 2025.