Finance Minister Siobhan Coady tabled Budget 2023 – ‘Your Health. Our Priority’ on Thursday afternoon.

Financial Landscape

- Newfoundland and Labrador will have a $160 million deficit this year. It will be in a surplus position next year, two years ahead of schedule.

- Revenue forecasts for 2023-24 are $9.7 billion.

- Increases in provincial spending total $108 million. This is lower than the rate of inflation.

- The Debt to Gross Domestic Product Ratio is approximately 37 per cent. In 2020, it was over 50 per cent.

- Oil production is 86.3 million barrels in 2023-24. Oil revenues in 2023-24 are expected to represent 12 per cent of overall revenues compared to 33 per cent in 2011-12.

- Oil price is forecasted at US$86 per barrel, while the Canada to United States exchange rate is 75.7 cents. This is based on independent forecasters.

- The projected borrowing required for 2023-24 is $1.5 billion.

Health Care

- More than $21 million for 10 new Family Care Teams across the province. This will provide access to primary care for up to 80,000 people when fully implemented, with more to come.

- $15 million for a new health information system.

- $9 million to begin to consolidate 60 separate road ambulance services into a single, integrated service with centralized dispatch.

- $5 million for a new virtual care program.

- More than $23 million for recruitment and retention of health care professionals.

- Increasing capacity in Memorial University’s Medicine Programs, which will have a year-over-year multiplier effect and ensure a steady stream of new recruits into the health system.

- $4.4 million for Flexible Assertive Community Treatment teams that will better assist individuals with mental health needs.

- Addition of 12 new drugs to the provincial drug program.

- $3 million for a Cardiovascular and Stroke Institute.

- Approximately $1.8 million for travelling orthopaedic teams and same day hip and knee replacement surgeries.

- $7.7 million this year and increasing to $9.3 million next year for health care professionals who support self-managed care in the home.

- $7.5 million annual increase for community care home professionals.

- $6.1 million annual increase for personal care home professionals.

Helping with the High Cost of Living

- No new taxes or fee increases.

- Elimination of the retail sales tax on home insurance.

- 8.05 cent per litre (includes HST) reduction on the price of gasoline and diesel – the second lowest rate among provinces.

- Doubling of the Physical Activity Tax Credit.

- $77.5 million for the Income Supplement, which includes a five per cent increase.

- $67.1 million for the Seniors’ Benefit, which includes a five per cent increase.

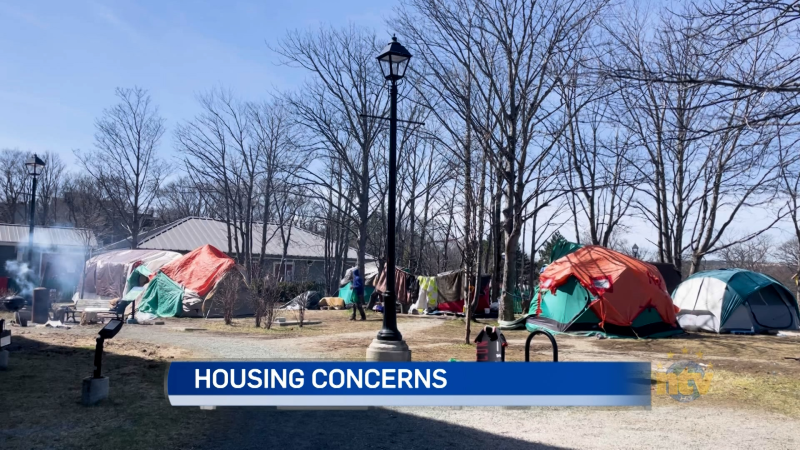

- More than $140 million for housing, including construction of more than 850 rental homes.

- Continuing the 50 per cent off the cost of registering passenger vehicles, light trucks, and taxis for another year.

- Maintaining the home heating supplement that provides up to $500 to residents who currently rely on furnace or stove oil to heat their home.

- $1.3 million to cover the cost of driver medicals for people 75 years of age and older.

Supporting Industry and Business

- Encouraging economic development by increasing the exemption threshold of the Health and Post-Secondary Education Tax from $1.3 million to $2 million. This will benefit 1,250 businesses.

- More than $1.1 billion for infrastructure projects, including an historic investment in provincial roads and highways.

- Expanding the All-Spend Film and Video production Tax Credit to 40 per cent.

- Increasing commission discounts to wine, spirit and cider producers in the province.

- A Manufacturing and Processing Tax Credit.

- A green technology tax credit.

- $140 million for workforce development.

- $1.5 million to improve air access.

Supporting Education

- $64 million to increase wages for early childhood educators, and improve accessibility to $10 per day child care.

- $12 million increase for the teaching services budget to add more teaching units bringing its total to just over $568 million.

Communities

- $6 million increase in base funding under Municipal Operating Grants over the next two years – $3 million this year, and another $3 million in 2024. Collectively, these increases will see the Municipal Operating Grant budget grow to $28 million.

- $19.2 million for settlement supports, including those for Ukrainians.

- $2.2 million to accelerate progress to reach immigration targets.